Our Story

The TV was once the domain of telcos and PSBs.

Now it’s the domain of hyperscalers.

We enable you to reclaim the TV home screen, control discovery, data, and revenue.

RedSquid is a tech-led, next generation TV OS platform established by television industry pioneers in 2025

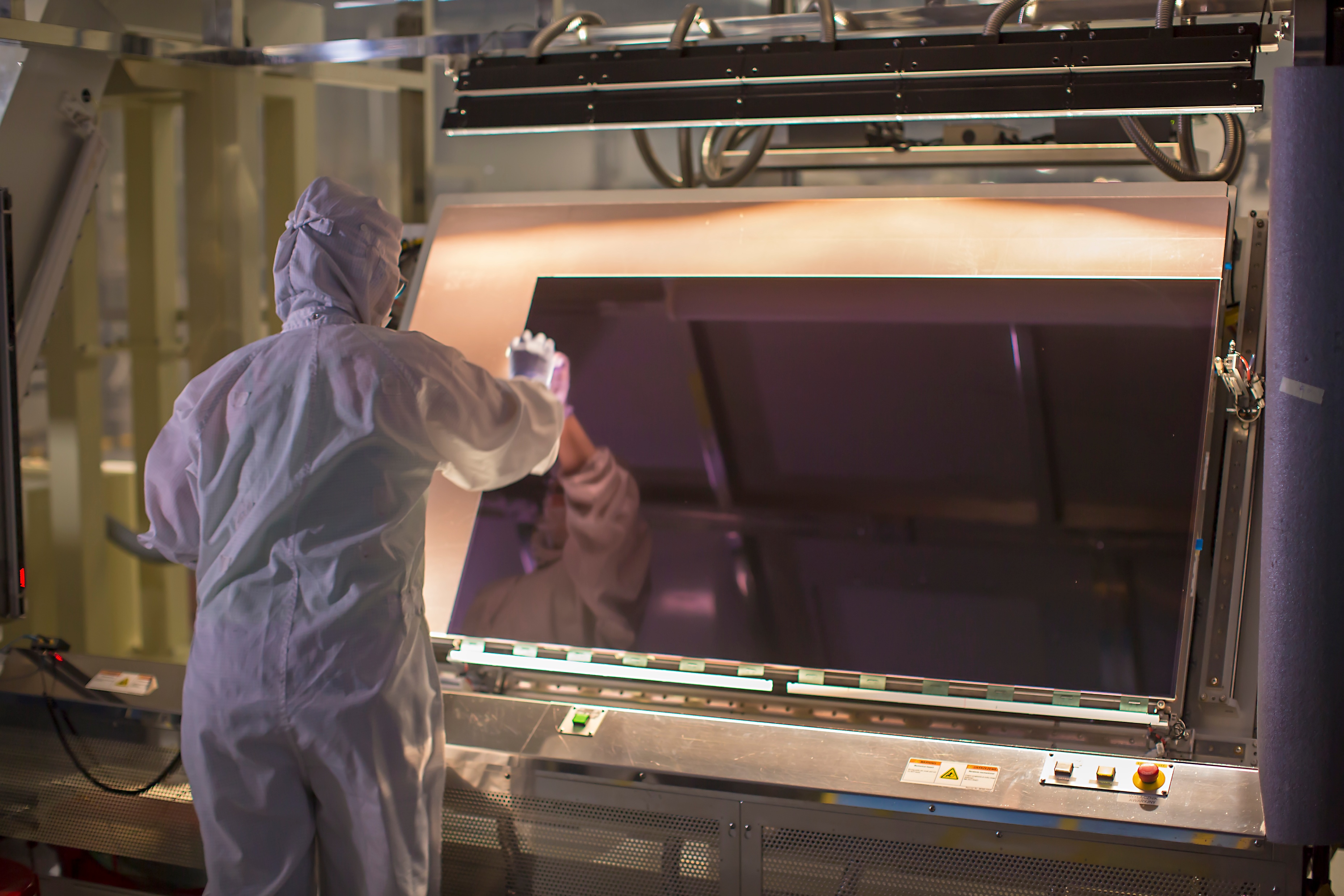

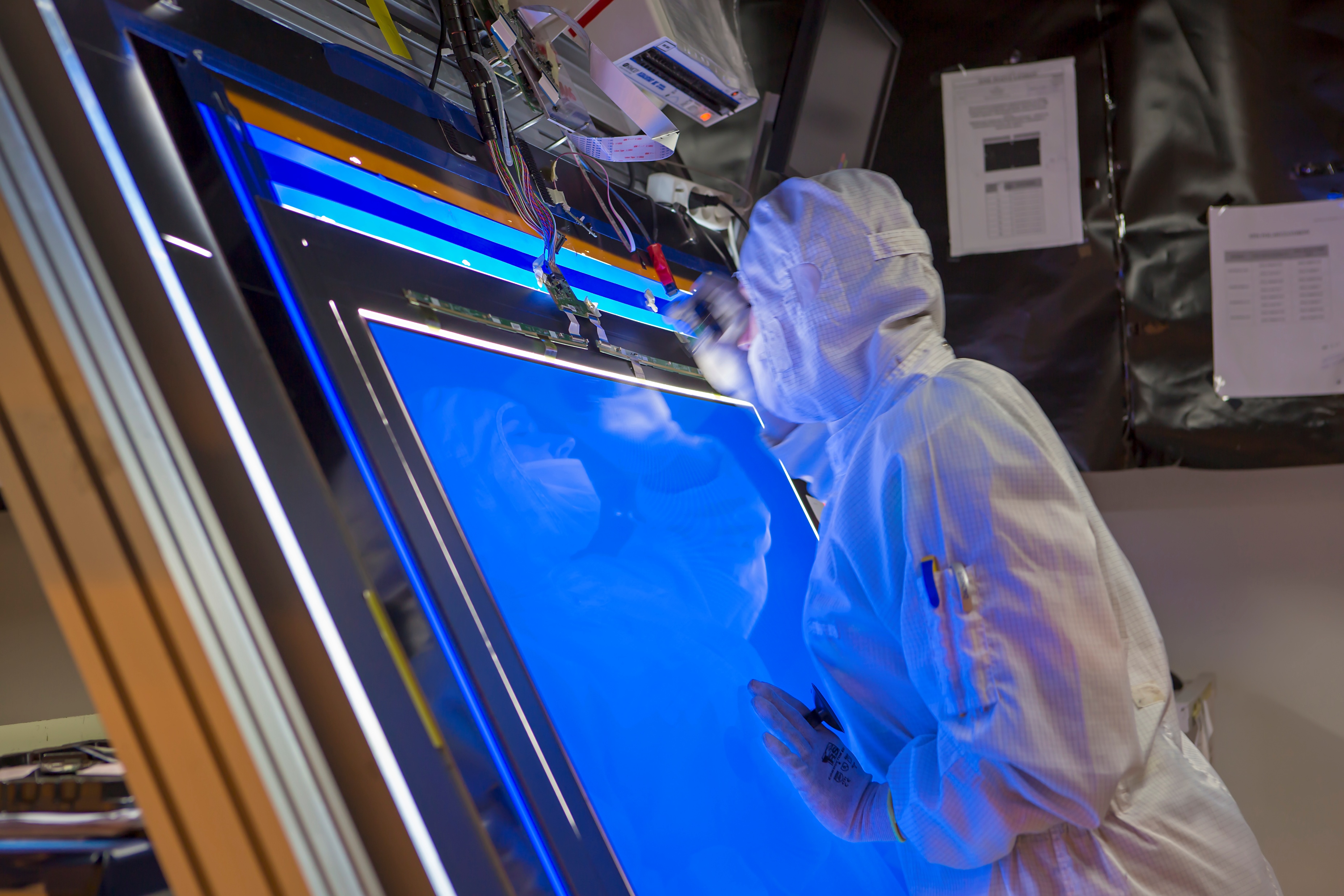

The team has been at the forefront of some of the most significant TV innovations globally over the past 30 years, from the launch of DVB-T in the late 1990s, to driving the global adoption of smart TVs with MStar Semiconductor in the early 00s, to the first operator supplied TVs in the 2020s. They have overseen the medium as it evolved from fixed channel grids and proprietary set-top boxes to app-driven streaming, cloud platforms, and global operating systems.

Today the team is innovating again. Bringing In-Device AI Algorithms to TV, enabling a new eco-system, creating new opportunities for TV manufacturers and Pay-TV operators to reclaim the living room.

By 2036, we believe that what sits at the centre of the living room – our home – will be far more than a “TV set” or “flat panel.” Rather, it will act as the primary home hub for entertainment, communication, ambient information, commerce, home security and control – where the old notion of “channels” gives way to orchestrated sessions that follow people across rooms and devices.

01

From Shrinking Bundle To Primary Interface

Over the past decade, value has shifted from the living room to global hyperscalers and OEM platforms. The real opportunity now lies in reclaiming the TV home screen—where control of discovery, data, and monetisation defines success. Our mission is to empower operators to become the central home interface, orchestrating video, cloud gaming, communication, smart home, and commerce through one seamless, operator-branded experience on the TV. No longer just another app, the telco becomes the household’s starting point for everything on the biggest screen.

Strategic Role For Telcos

RedSquid enables telcos to reclaim strategic control of TV and turn it into a driver of ARPU, retention, and data—not just a cost of doing business. By owning the home interface, operators control the full TV experience end-to-end, instead of ceding discovery, data, and monetisation to Smart TV OEMs and global platforms. This shifts the narrative from speed and price to value and engagement, making TV a true growth engine by bundling differentiated services, upselling value-added experiences, and deepening customer relationships.

02

The Value RedSquid Unlocks

RedSquid is built to move the four levers that matter most to a telco P&L: revenue, retention, data, and experience. Financed TVs, incremental UI monetisation, and privacy-centric advertising unlock new income streams on top of subscription, with typical deployments supporting 15–20% bundle ARPU uplift. Long-term financed TV plans, such as four-year terms, can improve retention by 25–35%, creating a lock-in dynamic similar to mobile handset contracts. Operators own audience insights outright with no intermediaries, turning TV usage into first-party data that powers smarter bundles, offers, and customer value strategies. A seamless, branded UX rivals leading TV OS platforms while preserving full access to major SVODs and app ecosystems, so subscribers enjoy the choice they expect within a coherent, operator-controlled environment.

03

The New Economics Of ‘Cognitive Television’

Next-generation TVs will pack far more GPU/NPU power and memory to support edge AI, cloud gaming, and rich interfaces, pushing up the underlying cost of the screen—just as the iPhone did for mobile. These intelligent displays will make upfront purchase harder for many households, turning financing from a nice-to-have into a must-have. RedSquid is built for this shift: direct operator-to-consumer TV sales become the norm, with screens optimised for managed broadband and long-term service quality. This plays directly to telcos’ strengths in billing, risk management, and device financing, making financed, operator-controlled TVs the default upgrade path for edge-AI-ready screens—locking in multi-year relationships and creating a more predictable ARPU layer.

04

What RedSquid Enables

RedSquid’s platform is built for the next decade of TV and edge AI. Intelligent super-aggregation delivers a unified UX and data layer that brings together linear TV, streaming, cloud gaming, and third-party services into one operator interface, with AI-driven discovery and personalised sessions across every household screen. A GPU/NPU-ready operator platform is tuned for low-latency graphics, cloud gaming, computer vision, and on-device AI, aligned with telco edge and cloud infrastructure so operators can finally monetise their network advantages. A cloud-native migration path provides a clear roadmap from legacy STBs to operator-controlled interfaces on smart TVs and devices customers already own, preserving brand, business rules, and prominence from power on, including the splash screen to the UX.

05

The Future We Build Towards

RedSquid’s vision is a world where the TV is no longer a neutral surface owned by third-party operating systems, but a cognitive, operator-controlled experience layer across the home.

In that world, telcos use TV to grow, not just defend—orchestrating content, commerce, and communication from a single interface powered by edge AI, privacy-centric advertising, and UI monetisation that works for subscribers and for the business.

Television’s Centenary

In 2026, television turns 100.

Television’s next century is about turning the big screen from a passive display into a private, intelligent edge device that understands context, intent, and opportunity. A hundred years ago in London, John Logie Baird’s “televisor” began TV’s journey from flickering experiments to a global mass medium, and today ultra-thin connected TVs stream on-demand, high-definition stories into billions of homes as software-defined devices that aggregate apps from global streamers, local broadcasters, and niche services into one interface.

For telcos and media groups, TV has shifted from a standalone product to a core part of converged bundles, CLV strategies, and data-driven engagement, yet despite all this change the core job of television has barely moved in 70 years, still primarily playing audio and video to a mostly passive viewer. Telephony shows how fast that can flip, with the smartphone turning a simple voice device into a personal computing hub, and television now stands in its own “pre-iPhone” era—powerful but familiar, waiting to be redefined by applications and intelligence.

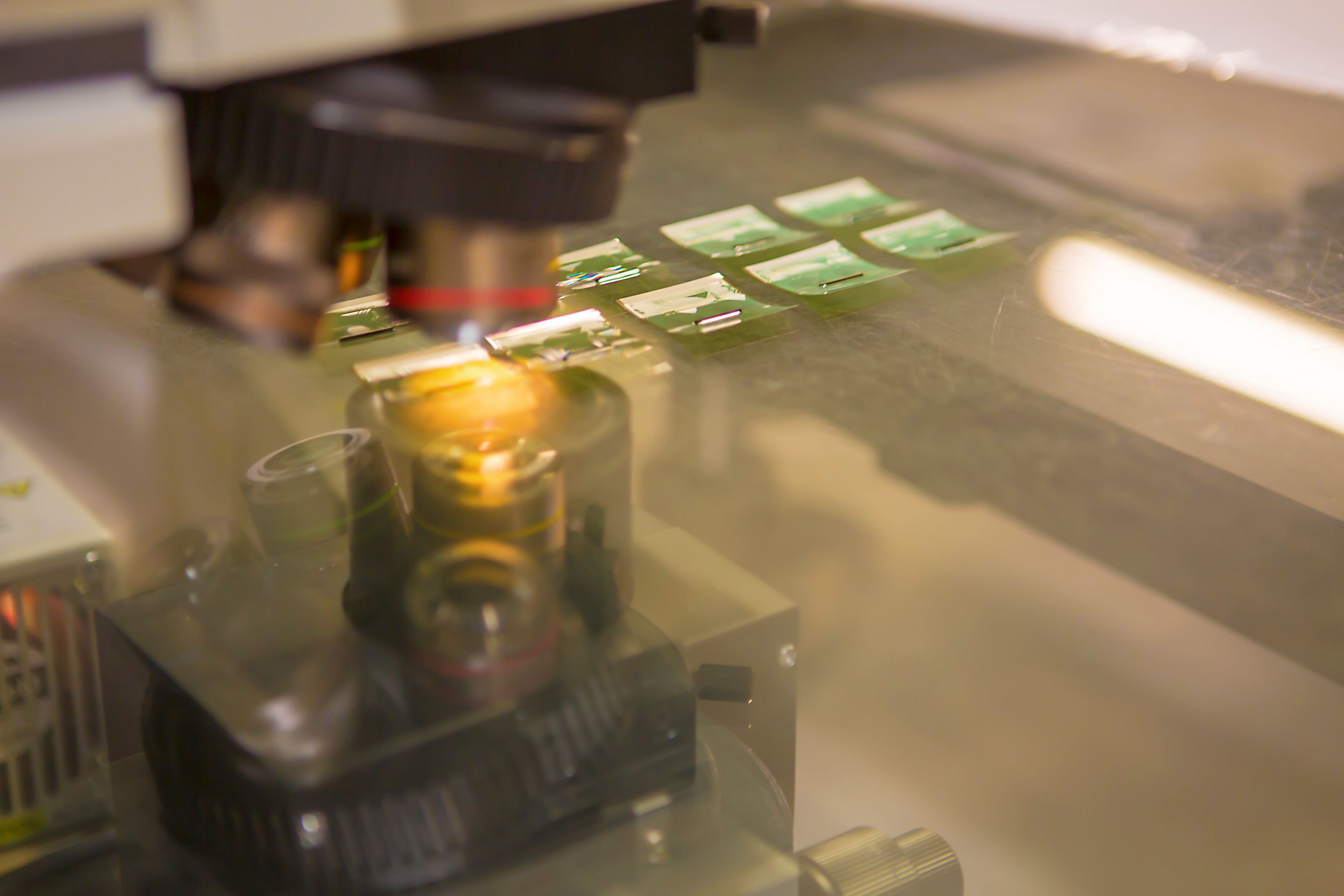

The catalyst for this shift is in-device AI, with edge AI running on the TV, rather than only in distant data centres, so on-device intelligence personalises the TV and turns it into an active participant that understands what is on screen, how viewers respond, and how to adapt without sending personal data out of the home. Over the next decade, AI will help TV evolve into an intent-driven, conversational interface that can orchestrate content, communication, commerce, and connected-home control, while cloud rendering and XR decouple “television” from a single panel to enable room-scale and wearable experiences that blend video, gaming, and real-time interaction. As TV moves from a one-way aerial model to a two-way broadband experience, new applications will work better on managed broadband connections, making displays optimised for the router and network increasingly important and placing the broadband supplier in a position of strength to provide the primary screen in the home.

In this new model, edge AI lets TVs deliver deeply personalised, privacy-centric ads by keeping sensitive viewing data on the device itself, where local models choose the right ad in real time using on-screen content, context, and coarse behaviour while raw logs and identifiers never need to leave the household.

On-device computer vision can understand each frame and insert branded objects or signage directly into the scene in real time without cloud video processing, so a drink on the table during a match or a suitcase in a travel show can be rendered differently per household while the underlying video and personal data remain private.

This creates a new contract between viewer, operator, and advertiser in which viewers see relevant, context-fit messages instead of crude tracking, operators define what appears in their environment and how data is used, and advertisers gain premium in-content inventory that respects regulation and consumer expectations.

TV’s evolution mirrors the wider disruption hitting telecoms and media, as software-first challengers reshape connectivity and global streaming and device platforms erode traditional TV ARPU, shifting value from exclusivity to experience where openness, simplicity, and intelligence become baseline rather than upsell features. If telcos continue to treat TV as a static distribution channel, more value will leak to platforms that own the OS, AI assistant, identity, and payments, but if they reframe TV as a cognitive experience, it can become a growth engine again, powered by edge AI, privacy-centric personalisation, and new in-content monetisation.